Customer Acquisition Cost

How much do you invest to acquire one new customer and does your LTV justify it?

Customer Acquisition Cost (CAC) is a game-changer for Software as a Service (SaaS) companies striving for triumph. Unravel the power of CAC, learn how to calculate it accurately, and uncover its synergies with other SaaS metrics.

What is CAC and Why Should I Care?

Customer Acquisition Cost (CAC) measures the average expense incurred to acquire each new customer. It holds the key to your financial health, scalability, and informed decision making. Lower CAC, while ramping up customer acquisition rates, empowers your SaaS company to grow exponentially and allocate resources intelligently.

Calculating CAC is a breeze with these steps:

CAC can be of three categories: New, Expansion and Blended. If you are calculating new CAC, following are the steps:

Pick a specific timeframe, like a month or a year.

Sum up your marketing and sales expenses for that period, excluding non-marketing salaries, account management costs, upgrades, upsells, R&D expenses, general overheads, and one-time expenditures.

Count the number of new customers acquired.

Divide the total expenses by the number of new customers to determine your CAC. Some customers while calculating CAC take the S&M cost of previous quarter or time period depending on the sales cycle.

Tracking CAC over time by customer cohorts to understand their behavior, assess marketing impact, and optimize customer retention can help understanding which segment is more profitable.

In case you are calculating expansion CAC, you need to include S&M cost related to upgrades and upsells as well.

When CAC joins forces with other metrics, remarkable insights come to light:

Customer Lifetime Value (CLTV): Compare CAC to CLTV to gauge the profitability of customer acquisition. If CAC exceeds CLTV, it's time to fine-tune your marketing and sales efforts.

Churn Rate: Combining CAC with churn rate highlights if you're acquiring customers who quickly churn. A high CAC paired with a high churn rate signifies the need for improved onboarding, product experience, or targeting strategies.

Conversion Rates: Analyze conversion rates alongside CAC to uncover bottlenecks in your sales funnel. By optimizing conversion rates, you enhance the efficiency of your CAC.

Try strategies to lower your CAC:

Targeted Marketing: Continuously refine customer profiles to focus your marketing efforts on the most promising segments, maximizing resource efficiency.

Conversion Rate Optimization: Optimize your sales funnel and customer journey to boost conversion rates and maximize CAC efficiency.

Marketing Channel Optimization: Analyze the performance of different marketing channels and allocate resources to the most cost-effective ones for better returns.

Customer Retention Focus: Prioritize customer retention strategies to minimize the need for costly customer acquisition.

Tracking CAC with Finesse using FP&A Tools:

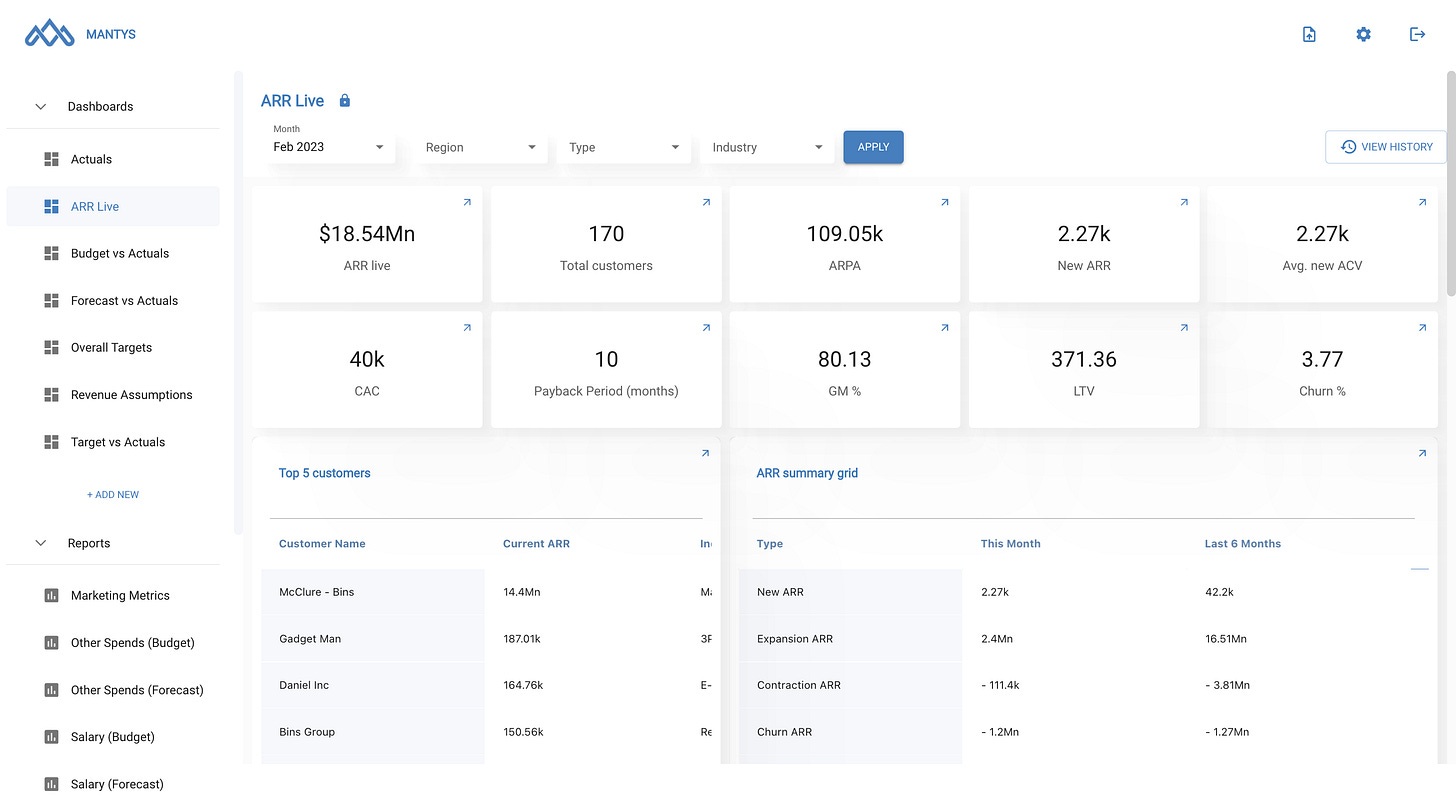

Companies can track CAC on a real-time basis with cutting-edge FP&A tools like Mantys. These tools offer real-time tracking of S&M costs & count of customers by integrating with Accounting tool, CRM and ERP. With Mantys, you gain data-driven decision-making power and streamlined financial planning, ensuring resource allocation that maximizes your CAC efficiency.

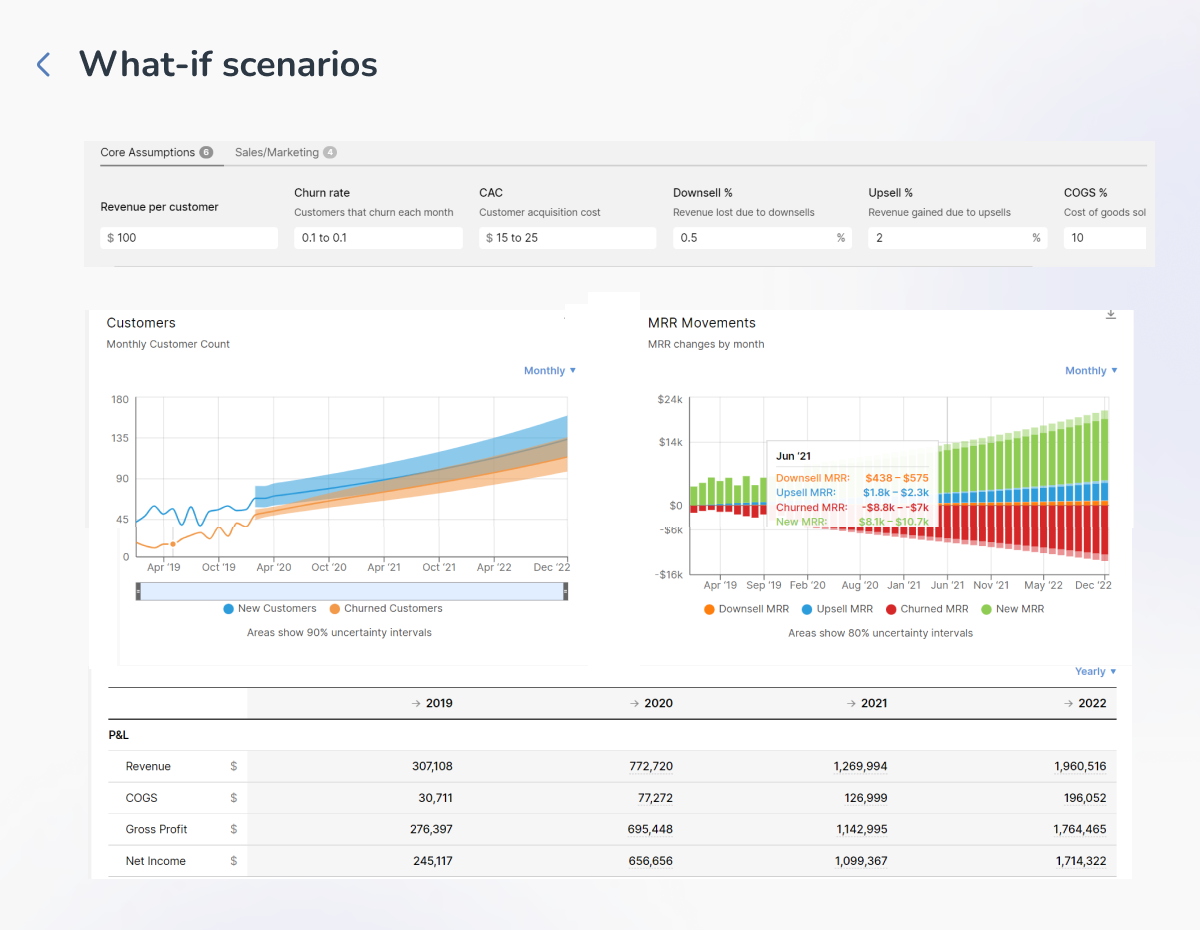

You can also create different what-if scenarios and plan, budget for the future based on CAC of each customer, how much you want to spend and see real-time impact on your ARR, runway and other metrics.

By understanding CAC, mastering its calculation, leveraging insights from other metrics, and harnessing innovative FP&A tools like Mantys, you can optimize your marketing and sales efforts, reduce costs, and achieve sustainable growth. Embrace the power of CAC optimization and empower your SaaS business to thrive in the fiercely competitive market.